Literature has argued that income inequality crowds out trust. However, whether income inequality makes people less trusting depends on how they perceive income inequality within their personal social context and social cognition. In this paper we therefore conjecture that the relationship of income inequality to trust depends on how income inequality affects inequality of life satisfaction. If life satisfaction inequality is high, distrust is generated among the least happy. This will increase polarization and the risk of rebellion, thereby also affecting trust among the happier people. Thus, life satisfaction inequality may be an essential factor in the relationship between income inequality and trust. In previous literature, the potential mediating role of life satisfaction inequality in the relationship between income inequality and social trust has not yet received attention. We test our model by panel analysis on 25 OECD countries in the period 1990–2014. The panel analysis shows that income inequality increases life satisfaction inequality and that both income inequality and life satisfaction inequality have a significant negative impact on social trust. Mediation tests show complementary mediation: besides the direct negative effect of income inequality on trust, we find an indirect effect mediated by life satisfaction inequality. This indirect effect counts for 20% of the total effect of income inequality on trust. Our results imply that policy options for increasing trust are not limited to countering income inequality, but can also include policy measures that directly reduce inequality of life satisfaction.

Avoid common mistakes on your manuscript.

In recent years, research interest has increasingly shifted to the role of income inequality as a determinant of well-being. With data based on fifteen years of research on income and wealth inequality, Piketty (2014) showed that income and wealth inequality have both been rising continuously since the 1980s. Sixty per cent of economic growth since the 1960s has gone to the top 1% (Piketty and Saez 2013). This has spurred interest in the effect of income inequality on well-being (Berg and Ostry 2011; Bastagli et al. 2012; Ostry et al. 2014; OECD 2012; Berg and Veenhoven 2010; Oshio and Kobayashi 2010; Schneider 2012; Zagorski et al. 2014; Verme 2011). Wilkinson and Pickett (2010) have argued that inequality negatively affects physical and mental health and therefore, ultimately, human flourishing. Empirical research has shown income inequality to have an impact on all kinds of socio-economic processes, posing a threat to the social tissue that is essential to keep the economy going (Berg and Veenhoven 2010; Oshio and Kobayashi 2010; Verme 2011; Zagorski et al. 2014).

Previous research has also shown that income inequality affects social trust (Kawachi and Kennedy 1997; Knack and Keefer 1997; Zak and Knack 2001; Oishi et al. 2011; Elgar and Aitken 2011; Barone and Mocetti 2016). Social trust in a society is important for several reasons. First, it is a prerequisite for achieving collective prosperity in a capitalist economy (Fukuyama 1995). Trust leads to openness and a willingness to close deals with other members of society (Rahn and Transue 1998). In addition, it reduces transaction costs, since high levels of trust require fewer checks and balances, as well as less detailed contracts or resources in the form of deposits or other guarantees to ensure the fulfillment of mutual obligations. As a result, countries with increased social capital levels, which strongly correlates with trust, have more efficient financial and labor markets. Another reason that the average level of social trust is so important is that it is a relational concept that captures those interpersonal or collective dimensions of a good society that are not reducible to the aggregation of how individuals are doing (Helliwell and Putnam 2004). Individuals can only truly flourish in relationship to other human beings.

That income inequality has a negative influence on social trust is not a given, however, as other research has not been able to identify this effect (Leigh 2006; Steijn and Lancee 2011; Bergh and Bjørnskov 2014). In this paper we will therefore focus on life satisfaction inequality. Since humans are social beings, a society would need relative equality in happiness levels to keep functioning peacefully (Kalmijn and Veenhoven 2005). Ovaska and Takashima (2010) have argued that keeping happiness inequality to a minimum is necessary in order to ensure that everyone benefits from increases in average happiness. The reason is that although there are macroeconomic policies that can ‘lift all boats’, an increase in average happiness does not by definition mean that everyone benefits. This is problematic, since big differences in happiness within countries pose a threat to social trust and political stability (Caruso and Schneider 2011; Guimaraes and Sheedy 2012).

Life satisfaction inequality might be a better predictor of social trust than income inequality, because there are theoretical reasons that the relationship between income inequality and social trust is contingent. Basing her argument on social cognition literature, Schneider (2012) has suggested that whether income inequality makes people more or less happy depends on how they perceive it within their personal social context. If income inequality is considered as representing a high potential for social mobility, people with low income might see significant inequality offering an opportunity for improving their situation later in life. The inequality has a positive value in this case. Then, the negative relationship between income inequality and social trust will disappear. Only insofar as income inequality is valued negatively will it increase inequality in life satisfaction and crowd out social trust. That means that income inequality may ultimately have a negative influence on social trust, but only indirectly through its influence on life satisfaction inequality.

While the link between income inequality and inequality in life satisfaction has had some attention in literature (Ott 2005; Ovaska and Takashima 2010; Delhey and Kohler 2011; Becchetti et al. 2013), the influence of life satisfaction inequality on social trust—and the potential mediating role of this type of inequality in the relationship between income inequality and social trust—has not so far been researched. It is the subject of investigation in this paper. Our principal research question is therefore as follows: How does life satisfaction inequality affect social trust, and to what extent does life satisfaction inequality mediate the relationship between income inequality and social trust? In order to answer our principal question, we look at two sub questions. First, how is life satisfaction inequality related to income inequality? Second, how is social trust related to life satisfaction inequality? Based on a sample of 25 countries, we used panel analysis to estimate the relationships between income inequality, life satisfaction inequality and social trust.

The structure of this paper will be as follows. Section 2 presents a review of the literature on the relationships between income inequality and trust, and between income inequality and life satisfaction inequality. Section 3 describes the relationship between life satisfaction inequality and trust, and introduces the conceptual framework and hypotheses, including the mediation hypothesis. Section 4 outlines our methodology. Section 5 presents the results of the empirical analysis, and Sect. 6 summarizes the main findings and discusses their policy implications.

No society can surely be flourishing and happy, of which the greater part of the members are poor and miserable. Adam Smith (1776, VIII page 94)

In this section we first present an overview of the literature on the relationship between income inequality and social trust. Then we examine the literature on the influence of income inequality on inequality in life satisfaction.

Generalized trust is one of the measurable components of social cohesion (Helliwell and Putnam 2004; Bjørnskov 2005). Generalized trust entails trusting people you do not know personally (Berggren and Jordahl 2006). If a certain group in a society is marginalized, this might make it feel less associated with the rest of the society, and trust that society less. If the marginalization endures, this group might either opt for violent resistance or develop aggressive opportunistic behavior towards the rest of society, resulting in higher crime rates and deteriorating social trust generally. In the words of Caruso and Schneider (2011: S38): “poverty and income inequality would feed frustration, hatred and grievance which make political violence more likely.” Thus, as income inequality decreases the life satisfaction of certain groups, it affects social cohesion and social trust within society as a whole. Piazza (2011) provides an overview of the literature on the link between socio-economic factors and terrorism, concluding that the economic status of a country’s minority groups is more important than the overall wealth of the country. This fits with the above literature on the psychological effects of income inequality.

A number of articles have been published on the link between income inequality and trust. Kawachi and Kennedy (1997) found a strong association between income inequality and the lack of social trust. Knack and Keefer (1997) and Zak and Knack (2001) provided further empirical evidence for this association, while Oishi et al. (2011) found that social trust is a robust mediator of the impact of income inequality on average life satisfaction. Elgar and Aitken (2011) also found a significant negative causal relationship between income inequality and trust, and showed trust to be a significant mediator in the relationship between income inequality and homicide statistics across countries. Leigh (2006) claimed that on a regional level, ethnic heterogeneity appears to be of greater importance than income inequality in explaining trust. On a national level however, he found a negative causal effect from inequality to trust. Steijn and Lancee (2011) have provided a thorough discussion of this relationship and the weaknesses of research on the topic. They argued that one must distinguish between inequality effects and wealth effects and must control for different impacts for high income countries and other countries. Their analysis of income inequality in 20 countries led to the conclusion that once national wealth is controlled for, inequality no longer seems to explain trust. They stressed, however, that their sample only includes countries with very little inequality, and this may explain their results. Nor did Bergh and Bjørnskov (2014) find a causal relationship between inequality and trust, while they did find an opposite causal relationship. However, they do not use panel data. Barone and Mocetti (2016) used a panel regression, in which they exploited predicted exposure to technological change as an instrument for income inequality. They also considered the income shares of the top 10 and the top 1 percent, as well as intergenerational income mobility, in addition to the traditional Gini index. They found that inequality negatively affects generalized trust in developed countries, regardless of which measure is used.

Among life evaluation standards, life satisfaction is one of the most prominent. It provides a comprehensive appraisal of life as it is, in comparison with how life should be (Chin-Hon-Foei 1989; Veenhoven 1990, 1995, 2000, 2002). While a vast body of literature exists on the study of average life satisfaction within nations as well as its relationship with income inequality (Oshio and Kobayashi 2010; Verme 2011; Zagorski et al. 2014), only a few papers have drawn attention to the relationship between income inequality and inequality in life satisfaction (Ott 2005; Ovaska and Takashima 2010; Delhey and Kohler 2011; Becchetti et al. 2013).

The positive link between inequality in life satisfaction and income inequality can be based on the standard micro assumption that utility increases with income (or consumption that income buys). People with higher income are generally more satisfied than people with low income. This means that the more unequal the income distribution, the higher the differences in life satisfaction. While this is true, marginal utility of income diminishes as income increases. Thus, one should expect that life satisfaction inequality would always be less than income inequality. The law of diminishing marginal utility is well established in economics and confirmed by much research (Hagerty and Veenhoven 2003; Easterlin and Angelescu 2009; Clark and Senik 2011; Layard 2010; Deaton 2008; Inglehart et al. 2008). Gandelman and Porzecanski (2013), who computed Gini-coefficients for income, happiness and utility, found that the Gini coefficient for happiness is indeed significantly lower than the Gini coefficient for income. Thus, they confirm that the concept of diminishing marginal utility also applies to life satisfaction (inequality).

Another explanation for the presumed link between income inequality and inequality in life satisfaction given by Becchetti et al. (2013) follows from the well-known finding that it is not absolute income but the differences in absolute income that people care about (Alpizar et al. 2005; Brekke and Howarth 2002; Carlsson et al. 2007; Clark and Oswald 1996; Solnick and Hemenway 1998). The impact of income on life satisfaction depends on the reference group to which most people compare their personal situation. On the one hand, if people associate with a nation or overall income at country level, national statistics will have an impact on how people feel about their social position, and thus impact on their life satisfaction. This may translate as an effect of income inequality on life satisfaction inequality, as the focus on relative income position enforces the perception of inequality.

On the other hand, a well-known phenomenon in economics is the keeping-up-with-the-Joneses effect, stating that comparison with neighbors and family in a comparable socio-economic position is more important than comparison with people or groups with whom one has no personal connection. In this case, overall income inequality may not be that important for life satisfaction inequality, as people do not compare their income with incomes at the national level. The reason for the gap between a person’s own income and their reference income causing concern is related to issues of envy and to greater work satisfaction, which in capitalist economies is often associated with high incomes (Van Praag 2011; Scitovsky 1973). If, for example, one has a high income in absolute terms, but little compared to his or her reference group, the high income would not lead to a high level of life satisfaction. On the other hand, it also implies that if one has a low income that is higher than the income of one’s reference group, then low income would lead to a high level of life satisfaction.

The empirical evidence on the relationship between income inequality and inequality in life satisfaction is mixed. Ott (2005) found no evidence that income inequality causes an increase in happiness inequality. In contrast to Ott, Ovaska and Takashima (2010) detected a strong and significant positive relationship between income inequality and happiness inequality. Delhey and Kohler (2011) found a similar result, while employing a slightly different measure for happiness inequality than that used by Ott (2005). Finally, using dummy variables for income lower than 60% of the mean income and for income greater than 200%, Becchetti et al. (2013) found that relative poverty has a positive effect on happiness inequality, while the second dummy representing relative affluence has no effect. An important note with respect to the empirical literature is that while Ott only looked at correlations (not at causal relations or regression analysis), Becchetti et al. used simple regression analysis, looking at the change over two time periods, whereas Delhey and Kohler and Ovaska and Takashima performed only a static cross-country analysis.

Based on the literature review discussed in Sect. 2, we can conclude that income inequality is likely to increase inequality in life satisfaction and decrease social trust. However, in our paper, we are principally interested in the missing link in the triangle of income inequality—life satisfaction inequality—trust, that is: the relationship between life satisfaction inequality and trust. In this section, we first describe this relationship. Next, we present the hypotheses and the model. Lastly, we discuss the mediating role of life satisfaction inequality in the relationship between income inequality and trust.

Whereas there is a substantial amount of research into the relationship between income inequality and trust (see Sect. 2.1) and average life satisfaction and trust (Helliwell 2003, 2006; Bjørnskov et al. 2007, 2010; Oishi et al. 2011; Graafland and Compen 2015), there is no literature that presents empirical research on the influence of inequality in life satisfaction on social trust. But based on social cognition literature, some conjectures can be made.

Schneider (2012) has shown public perceptions to be important to the significance of income inequality. She has argued that individuals may not be affected by income inequality at the contextual level (i.e. as a concept or philosophical idea of fairness), but by ‘their personal experiences within their immediate environment’ (i.e. the displeasure over the fact that they earn less income for the same amount of work than their neighbor, or the loss in status associated with that). Whether income inequality makes people more happy or less happy depends on how they perceive that inequality within their personal social context and social cognition (Howard 1994; Fiske and Taylor 1984). This in turn shapes their perception of society and of other people’s behavior. Schneider mentioned two ways in which inequality is evaluated by individuals, which are (the fairness of) distributional outcomes and distributional procedures (also Wegener 1999). The first is referred to as the degree of preference for equality, while the second is referred to as the degree of preference for social mobility. Schneider concluded that theoretically, individuals with little education and limited control over their resources are likely to perceive social mobility to be impossible, and therefore tend to be more strongly affected by income inequality in a negative way. It would then be this negative perception and the resulting dissatisfaction that would lead to other negative outcomes, such as a lack of trust. But if income inequality is considered to represent high potential for social mobility, it could have a negative rather than a positive effect on life satisfaction inequality, as even people with low income would perceive high inequality as an opportunity to improve their situation later in life. Hence, based on her empirical analysis, Schneider concluded that it is the perception of the level of legitimacy of income inequality, related to both ways of evaluation, that affects subjective well-being, rather than the level of income inequality as such (although one affects the other). Based on this argument, inequality in life satisfaction is expected to be more closely correlated with social trust than income inequality, as the influence of the latter is contingent on the social cognition.

Using discontent theories and expected utility theories, Guimaraes and Sheedy (2012) have also linked happiness inequality to social unrest. The idea put forward by Guimaraes and Sheedy is that power differences generate happiness inequality. Because of the lack of freedom and the frustration this generates among the oppressed, they harbor distrust and contempt for the powerful and are likely to support rebellion. The lack of happiness provides a strong ground for social upheaval. Individuals rebel only if they feel miserable and perceive that things cannot get any worse for them (Caruso and Schneider 2011). Whether violence breaks out therefore depends on the level of dissatisfaction and moral frustration. This also lowers trust among the powerful, and destabilizes a country. Thus, higher life satisfaction inequality supposedly has a strong impact on trust across all classes. The higher the inequality in life satisfaction, the higher the level of dissatisfaction among the least advantaged and the lower social trust will be.

Based on these arguments from social cognition theory and discontent theories and expected utility theories, we conjecture that inequality in life satisfaction increases social distrust.

From the preceding findings and arguments discussed in Sects. 2 and 3.1 we propose a set of three interrelated hypotheses regarding the relationships between income inequality, life satisfaction inequality and trust:

Income inequality decreases social trust

Income inequality increases life satisfaction inequality

Life satisfaction inequality decreases social trust

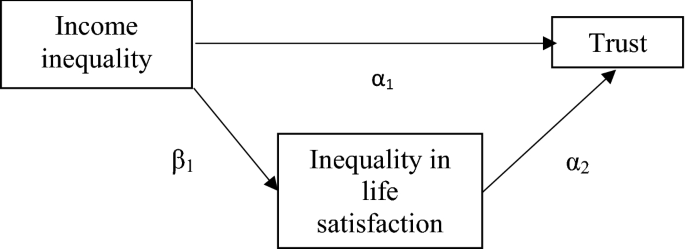

Whereas hypothesis 1 and hypothesis 2 can be derived from previous literature, it is the combination with hypothesis 3 that creates a new conceptual framework for studying the relationship between income inequality and trust. This framework is reflected in Fig. 1.

In mathematical form, the model can be formulated as:

$$Trust = \alpha_ <0>+ \alpha_ Income\,Inequality + \alpha_ Life\,Satisfaction\,Inequality + \alpha_ X_$$

$$Life\,Satisfaction\,Inequality = \beta_ <0>+ \beta_ Income\,Inequality + \beta_ Z_$$Xi denotes control variables in the equation of trust and Zj control variables in the equation of life satisfaction inequality (see below).

The framework summarized in Fig. 1 can be interpreted as a mediation model. A mediation model is a model that seeks to identify and explain the mechanism or process that underlies an observed relationship between an independent variable and a dependent variable via the inclusion of a third hypothetical variable, known as a mediator variable. Mediation analysis thus facilitates a better understanding of the relationship between the independent and dependent variables. Baron and Kenny (1986) state that a given variable may be said to function as a mediator (M) to the extent that it accounts for the relation between the predictor (X) and the criterion (Y). In a formula: X → M → Y.

In the context of our model, X represents income inequality, M life satisfaction inequality, and Y trust. As argued above: whether income inequality makes people less trusting depends on how they perceive it within their personal social context and social cognition. Only if income inequality leads to more inequality in life satisfaction, is it to be expected to have a negative effect on social trust. If income inequality is positively valued by both high and low- income groups, as in the case of preference for social mobility, it is to be expected that the negative relationship between income inequality and social trust breaks down. But if the preference for equality dominates, income inequality will increase inequality in life satisfaction and be a source of social tension and distrust. In this paper, we therefore conjecture that inequality in life satisfaction mediates the impact of income inequality and trust. This leads to the following mediating hypothesis:

Life satisfaction inequality mediates the negative effect of income inequality on trust

In our model, trust may therefore not only be directly but also indirectly related to income inequality. In Fig. 1, α1 represents the direct effect of income inequality on trust that is not mediated through life satisfaction inequality. α2β1 represents the indirect or mediation effect and has been termed the product of coefficients. (Preacher and Hayes 2008). The product of α2 and β1 is, in essence, the amount of variance in trust that is accounted for by the income inequality through the mediation mechanism of life satisfaction inequality. The total effect of income inequality on trust is equal to the sum of the direct and the indirect effects. The indirect effect thus reinforces the direct effect of income inequality on trust.

Zhao et al. (2010) state that, for mediation to be empirically confirmed, α2β1 should be significant. If α2β1 and α1 are both significant and share the same sign, this is called complementary mediation. If α2β1 and α1 are both significant but have different directions, there is so-called competitive mediation.

For reasons of comparability and availability of data, we created a sample of 25 countries that are all members of the OECD. The countries included in the regression analysis are reported in Table 1.

Table 1 List of countriesMost data in our model cover the period of 1990–2014, while the number of observations per country varies from 1 to 5 for trust, and from 9 to 18 for income and life satisfaction inequality. As shown in Table 2, the dataset used in the empirical analysis has been constructed from different sources.

Table 2 Descriptive statisticsThe data for income inequality are taken from Solt’s Standardized World Income Inequality Database, and refer to the net Gini coefficient (after taxes) (Solt 2016).

The data for life satisfaction inequality (LSI) were taken from Veenhoven’s World Database of life satisfaction. Our indicator for life satisfaction inequality consists of the normal standard deviation of average life satisfaction per country. Footnote 1 Life satisfaction is based on the self-rating of individuals answering the question “All things considered, how satisfied are you with your life” and is measured on a four point scale.

For social trust, we used two different measurements. First, we used the well-known trust data of the World Value Studies (WVS) and European Value Studies (EVS). These data reflect self-rated responses to the question “Generally speaking, would you say that most people can be trusted or that you need to be careful in dealing with people.” People could respond “most people can be trusted” or “need to be very careful.” The scales in WVS and EVS express the share of respondents that selected the option that “most people can be trusted.” Footnote 2 In addition, we used data for trust from the Social Indicators database of the Institute of Social Studies of Erasmus University Rotterdam (ISS). This indicator consists of a harmonized measure of trust based on various statistical reports such as social trust (similar to the WVS indicator) and perceptions of safety, combined with a number of crime statistics. These include statistics for various types of theft, assault, and homicide. Thus, it provides a measure of trust that is more objective than the trust indicator of World Value Studies, as it does not only rely on people’s perceptions, which are prone to cultural biases, but also on simple indicators of the strength of communities. This allows us to not only analyze whether income inequality and life satisfaction inequality affect the perception of trust, but also whether they affect the actual strength of the bonds between members of societies. Since there is some debate in literature as to whether measures of perceived trust are suitable for economic analysis, due to cultural characteristics that might affect comparability (Bjørnskov 2005; Leigh 2006), we prefer to use both perceived trust and this more objective alternative. If we find support for the hypotheses for both types of datasets, we believe this makes our analysis stronger, as it shows that our conclusions do not depend on subjective indicators alone.

While we used inequality of income and life satisfaction, we used average (or levels of) trust, in accordance with the literature. The main theoretical reason is that levels of trust, across the whole range of the population of a society, are more important in maintaining a functioning nation. Low trust, among one group or within the broader population, becomes problematic when it starts to affect even the most trusting segment of the population, and this is reflected in low levels of average trust. However, it would be interesting to study this in more detail and distinguish between in-group trust and out-group trust for example. Unfortunately, data availability makes this impossible.

In our analysis, we controlled for a number of different variables. First, we controlled for the logarithm of GDP per capita. GDP per capita has been shown to affect trust (Barone and Mocetti 2016; Dolan et al. 2008; Frey and Stutzer 2002; Stevenson and Wolfers 2008; Fischer 2008). Furthermore, it is likely that GDP also affects the inequality in life satisfaction. The law of diminishing marginal utility of income implies that, given a certain level of income inequality, a rise in the average level of income per capita will reduce inequality in happiness. The reason is that it will lift many people out of poverty and put them in a situation of comparable life satisfaction, while the impact on life satisfaction of people with higher incomes will be limited. As Gropper et al. (2011) argued, other potential control variables (for example, life expectancy, skill level, and other indicators) are highly correlated with GDP per capita. Thus, GDP per capita is likely to capture most of the variation associated with any omitted variable.

Based on previous literature, we added several other control variables. First, we controlled for the ratio between men and women for trust as a cultural characteristic (Leigh 2006). Furthermore, the unemployment rate may affect inequality in life satisfaction and trust (Ovaska and Takashima 2010; Steijn and Lancee 2011; Barone and Mocetti 2016). As institutional variables, we include religion (Christianity and Islam) (Steijn and Lancee 2011), political rights, civil liberty, and monarchy. Monarchies are deemed to be more trusting, having a more stable political system and less need for full democratic accountability (Bergh and Bjørnskov 2014; Bjørnskov 2005; Bjørnskov et al. 2007; Robbins 2012). As demographic variables, we include the share of population aged 65 and above, the population dependency ratio and infant mortality ratio (Bjørnskov et al. 2008; Ovaska and Takashima 2010; Barone and Mocetti 2016). Finally, in the regression analysis of trust we include the share of exports over GDP (Barone and Mocetti 2016) and the urbanization rate (Bennett and Nikolaev 2014) as additional controls. Footnote 3

Before performing regression analysis using panel data, one must test whether there are random or fixed effects in the data. Fixed effects are generally used to control for unobserved heterogeneity when heterogeneity is constant over time. Random effects models are more appropriate when it is expected that differences across entities (or countries) influence the dependent variable. To determine which model is correct, we performed the Hausman test. This tests whether the residuals are correlated with the independent variables. If the error terms are significantly correlated with the other regressors in the model, the fixed effect model is consistent and the random effects model is inconsistent. If the individual effects are not correlated with the other regressors in the model, both random and fixed effects are consistent and the random effects model is more efficient. As the Hausman tests were not significant, we used the random effects model. Furthermore, since we found some indication of heteroscedasticity in the regressions of trust, we used robust standard errors.

In order to control for correlation between the residuals for life satisfaction inequality and social trust, we use the CMP (“conditional mixed process”) estimator with robust standard errors to test the hypotheses. CMP fits a large family of multi-level and seemingly unrelated systems. Random effects at a given level are allowed by default to be correlated across equations. The method is conditional, meaning that the model can vary by observation. This is a great advantage for our model, since we have many more observations for estimating the equation for life satisfaction inequality than for the equation of social trust. In short, it is an estimation method that accommodates differences in the number of observations per country and per variable, while allowing for complex relations and a flexible model definition.

In the interpretation of the results of the regression analysis, we should be aware of the possibility of a simultaneity bias because of inverse causality from dependent on independent variables. As Bergh and Bjørnskov (2011) showed, countries with higher trust levels are more prone to have larger welfare states, thereby reducing inequality. This suggests that higher trust might have a negative reverse effect on income inequality. However, as discussed above, research by Barone and Mocetti (2016) using instrumental variables showed that there is a negative causal effect of income inequality on trust. Furthermore, it can be noted that reverse effects would materialize with long lags, as institutional changes take a long time to accomplish. The shorter the time period in which the negative effect of income inequality on trust becomes manifest, the more likely it is that the estimated relationship stems from the causal effect of income inequality on trust as predicted by hypothesis 1.

Furthermore, Guimaraes and Sheedy (2012) have argued that redistribution is a common tool used to quash the risk of rebellion that springs from high inequality in life satisfaction. This suggests there is also a theoretical possibility that high life satisfaction inequality has a negative reverse impact on income inequality. However, inequality in life satisfaction may also have a positive reverse effect on income inequality because people that are happier may be more inclined to work harder, or be more creative and entrepreneurial, and earn a higher income (Frey and Stutzer 2002). If these positive and negative reverse effects cancel out, our estimation results will be unbiased. Unfortunately, proof can only be given if we can disentangle the causal relations predicted by our conceptual framework from possible other, reverse, causal effects, by using instrumental variables. But we lack data for such instrumental variables. Also, Ott (2005), Becchetti et al. (2013), Delhey and Kohler (2011) and Ovaska and Takashima (2010) do not test causality in their estimation of the relationship between income inequality and life satisfaction inequality. Therefore, we should interpret the results of our empirical analysis with care. However, as the reverse effect of life satisfaction inequality on income inequality can be positive as well as negative, it is a priori likely to be rather small. That means that if we find a strong positive effect from income inequality on life satisfaction inequality, the posterior probability that this empirical relationship reflects the causal impact predicted by our model is relatively high.

This section presents the results of the empirical analysis, starting with the correlation analysis of dependent and independent variables. Next, we will present the panel regression analysis.

Table 3 reports the Pearson correlation coefficients. Trust is negatively correlated with life satisfaction inequality and the net Gini coefficient. Furthermore, the indicators for life satisfaction inequality (LSI) and net income inequality are positively correlated, as are also the two indicators for trust.